Robust U.S. stock momentum hit a slowdown in the third quarter, even as strong company earnings results rolled in. Fundamental Equities’ U.S. and Developed Markets CIO Carrie King weighs in on the incongruence with three reflections from Q2 earnings season.

U.S. stocks as measured by the S&P 500 Index are on track for 11% year-over-year earnings growth in Q2, setting up to be the strongest quarter since Q1 2022. As we projected in our Q1 earnings highlights, growth of the AI-fueled “Magnificent 7” stocks slowed from its torrid pace to a still stellar 30%. The “other 493” posted positive results for the first time in five quarters ― and their fastest growth in seven quarters, at 7%. We see that number trending up as Mag7 earnings growth comes down to earth, significantly closing the earnings growth gap.

All told, it was a good earnings season. Not only did actual results come in better than analyst expectations but 82% of companies beat profit estimates, a higher number than we’ve seen historically. And yet, markets faltered.

Below are three observations from earnings season that in some ways say more about investor sentiment than they do about company fundamentals.

1. Artificial intelligence (AI): To spend or not to spend?

The answer, according to the four largest hyperscalers in the U.S.: Spend … big. In fact, when it comes to AI, the CEO of one of these companies noted on their Q2 earnings call that “the risk of underinvesting is dramatically greater than the risk of overinvesting.” Aggregate capex spending intentions as reported by these leading hyperscalers increased more than 50% from 2023 to over $200 billion for 2024 ― with further double-digit growth on tap for 2025. We think there’s room for even more upside.

Whereas markets seemed to cheer the swell in investment last quarter, this time they chose to focus on whether the spending will earn an ample return on investment. These fears stoked a correction in technology shares. Our Global Technology investment team sees this summer swoon as temporary, with AI momentum powering on and offering compelling opportunity that is only just beginning.

Indeed, AI looks well poised to continue shaping the investment opportunity set. We’ve previously highlighted the healthy prospects in infrastructure development after years of underinvestment. Many of those infrastructure projects are large tech projects ― the build out of AI “factories,” or data centers needed to support mass use of AI across industries. Q2 earnings offered evidence of this beginning to bear out. One example: A global leader in data center power controls beat their earnings estimates and raised forward guidance, citing better-than-expected orders and an increased backlog.

Investment takeaway: We expect AI to continue driving markets, but discernment matters. In the context of overall flat IT spending budgets, we’re cautious on parts of the ecosystem that are not prioritized for spending. This includes software, an area that is largely on pause as companies look to adapt their applications to AI and customers hold back on renewing subscriptions and committing to purchases of legacy products.

2. Healthcare: To grow or not to grow?

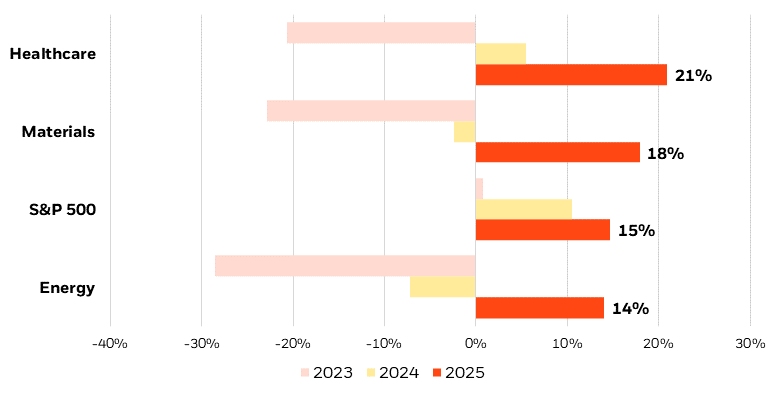

The answer: Grow. The healthcare sector logged the lowest year-over-year earnings growth in Q1 but took a turn this quarter to post among the highest growth across S&P 500 sectors. The outlook also looks bright, with healthcare leading 2025 earnings acceleration, as shown below.

A return to earnings “health”

Trailing and forward earnings growth, S&P 500 and top-growing sectors

Source: BlackRock Fundamental Equities, with data from FactSet as of July 31, 2024. Chart shows aggregate analyst earnings growth estimates for the S&P 500 Index and sectors with the strongest forward growth outlook. Past performance is not indicative of current or future results. Indexes are unmanaged. It is not possible to invest directly in an index.

Notwithstanding the overall strong Q2 results, we saw mixed feelings manifest here as well. An example: The two prominent makers of GLP-1 diabetes and weight-loss drugs had divergent earnings developments, yet they were punished equally in the market downturn.

Elsewhere, hospitals are advancing their post-COVID rebound as demand for procedures normalizes. Labor pressures are also starting to ease after pandemic-era nursing shortages. Hospital cost bases are improving as the need to hire temporary workers ebbs and nursing costs stabilize. One of our favored hospital holdings posted an unexpected 60% rebound in Q2 earnings and guided higher as strong procedure growth intersected with moderating cost trends. Makers of medical tools are knock-on beneficiaries, as now-profitable hospitals begin to spend on equipment.

Who suffers? Business fundamentals for managed care companies exhibited signs of stress in the quarter as the uptick in procedures led to higher costs and less favorable medical loss ratios, a measure of premiums earned relative to the amount insurers spend on medical claims.

Investment takeaway: Healthcare presents a story of bifurcation. Overall valuations are attractive and the earnings outlook is positive. Yet not all areas offer equal appeal. Big U.S. pharma companies, for example, represent risk as they face a looming patent cliff. But drug distributors benefit as patents expire and more generics come on the scene for distribution. And, pertinent to this year, drug distributors also tend to be relatively shielded from typical election-related volatility. Healthcare remains a favored sector across our global Fundamental Equities platform and, we believe, offers rich stock-picking potential.

3. Consumers: To shop or not to shop?

The answer: It depends. We’ve long noted signs of stress in the consumer, particularly the lower-income cohort. The cracks are seemingly widening today. A leading fast-food chain with a global footprint saw sales decline in the second quarter for the first time in more than three years. Management’s stated mission: Do better creating value for customers.

Years of high inflation are having an impact. Pricing power is coming into question as companies are having to adjust their prices to maintain demand.

The middle and high-end markets are generally stronger, but not immune. Even some luxury brands saw sales pressure as shoppers reined in spending on concerns of economic weakness. Makers of some big-ticket items like motorcycles and appliances cut guidance, and a major credit card company missed on top and bottom line.

Other instructive anecdotes: A leading home improvement chain showed no growth in Q2 after five consecutive quarters of earnings decline and signaled a continuation of the weakening trend on their earnings call. Meanwhile, America’s largest retailer and low-price leader posted strong Q2 results and raised its outlook ― a more positive read on consumer health but also evidence of value-seeking behavior and higher-end consumer trade-down.

The ultra luxury segment seems to be displaying the greatest resilience, benefiting from higher incomes and market gains bolstering investments.

Investment takeaway: Amid sorted signals on consumer health, we lean into companies with differentiated products and resilient pricing power. Strong brands with a faithful and income-secure customer base are relatively attractive. We’re comparatively cautious on companies catering to customers particularly impacted by still high interest rates.

Bottom line

Our clear message among the many mixed messages in today’s market is that stock selection matters. A deep understanding of industry dynamics and individual company fundamentals can not only be beneficial to investment outcomes, but also can offer some reassurance when bouts of market volatility like those we saw this summer test investor conviction.