Technology stocks led the market for much of this year, with AI euphoria in full effect. Recent cracks in the momentum have caused some investors to question whether the enthusiasm has been exhausted. Technology investors and active stock pickers Tony Kim and Reid Menge offer answers ― and an optimistic outlook.

The tech sector powered global equity markets higher in the first half of 2024, led by an elite group of mega-cap stocks leveraged to the advancement in artificial intelligence (AI). These leaders, dubbed the “Magnificent 7” in 2023, retained their luster through the first half of 2024 as AI momentum continued unabated. July introduced a speed bump that stirred consternation for some tech investors.

What next for tech?

Can the sector’s strong performance continue? We believe it can and see the summer setback as temporary. That said, we do observe greater differentiation across technology stocks, even among the Magnificent 7 as the market attempts to assign “winners” and “losers” in the race for AI development, enablement and adoption.

Our recent week-long tour and conversations with the leaders of 29 public and private technology companies in San Francisco and Silicon Valley confirmed our underlying thesis: AI is here to stay and we’re only at the tip of the iceberg in terms of the investment opportunity.

Today, monetization of AI resides primarily in the buildout of AI “factories.” Hyperscalers, private enterprises and government entities are pouring hundreds of billions of dollars into the construction of these data centers, namely by spending on clusters of GPUs in the race to support ever-larger AI models. GPUs, or graphic processing units, are the type of semiconductor that is critical for generative AI training and inference workflows.

Meanwhile, use cases and real-world applications of AI are in much earlier stages, with significant impact from AI products not expected until 2025. This is leading to cautious spending on software development, while software customers are likewise delaying purchases in anticipation of AI advancements. The chart below illustrates how this divergence has manifested in returns across technology subsectors.

Shades of good fortune

Total returns across technology subsectors, 2023-2024

Source: BlackRock Investment Institute, with data from LSEG Datastream, Aug. 5, 2024. Data is rebased to 100 at Jan. 1, 2023. Past performance is not indicative of current or future results. Indexes are unmanaged. It is not possible to invest directly in an index.

According to a Morgan Stanley survey of CIOs, 50% of AI spending is drawn from existing IT budgets, suggesting AI investment is supplanting other IT spend. Hyperscalers offering cloud services are consuming a large portion of enterprise IT budgets.

This type of bifurcation underscores the heavy influence that AI is having across the economy and markets, with its evolution driving the investment opportunity set. AI momentum reinforces our outlook for future returns, and the differentiation we’re seeing does nothing to dim that. Rather, it highlights the need for individual stock research and selection to capitalize on the opportunities as the AI evolution advances.

A market without precedent

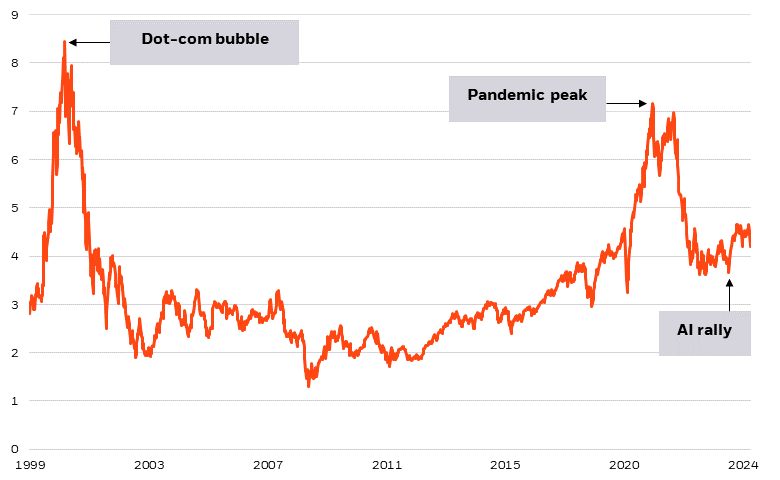

The technology sector’s strong performance last year and into 2024 has prompted questions as to whether technology stocks are overvalued. Some have made comparisons to the dot-com bubble of the late 1990s and the pandemic-era market where the “digitization of everything” led to heavy IT investment and historically low interest rates supercharged tech stocks. Both ended in busts.

We don't think today’s market is akin to either of these periods. The chart below illustrates the valuation difference relative to the dot-com bubble and pandemic peak. Much of the skepticism on tech’s ability to power on is based on trailing sales and earnings estimates. Yet many tech stocks are cheaper today than they were before the rally began in 2023 when factoring in revisions to forward-looking earnings estimates. As of July, the average 2024 earnings growth forecast for the technology sector stood at 20%. This represents a notable increase from early-year estimates, while profit margins in the sector have also expanded.

No comparison

Technology sector equity valuation multiples, 1998-2024

Source: BlackRock Fundamental Equities, with data from FactSet as of July 31, 2024. Chart shows the enterprise value to revenue ratio of 1,040 public tech companies with a market capitalization over $1 billion.

We believe earnings growth can remain healthy for the technology sector broadly, fueled by the build out of AI and a commitment to cost prudence on the part of tech firms.

That said, we evaluate company fundamentals on an individual basis with an emphasis on owning the right names at the right price. Our team of technology-focused, fundamentals-based stock researchers and selectors is looking to identify the next areas of opportunity while also assessing which business models may be at risk as AI becomes increasingly sophisticated.

In all, we believe the rapid evolution of AI and all of its ramifications makes investing in this space very much an active pursuit. Volatility such as that seen of late, while always unsettling, is not unexpected and could present buying opportunities in this exciting and, we believe, enduring theme.