Navigating retirement savings during volatile markets

Market volatility can startle even the most experienced investors. No matter where you are on your retirement path, it's important to keep the following in mind when deciding whether or not to remain invested.

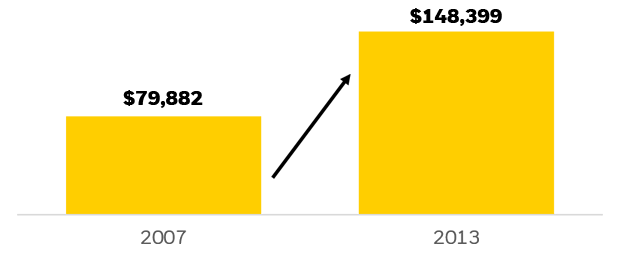

New contributions may grow after market volatility

Investors who can continue contributing to their retirement have the potential to take advantage of market recoveries. For example, those who stayed in their plan from 2007 through 2013 saw their average account balances increase by 86%1.

For illustrative purposes only. Past performance does not guarantee future results.

New contributions can take advantage of attractive pricing as the markets recover.

Staying invested in market downturns

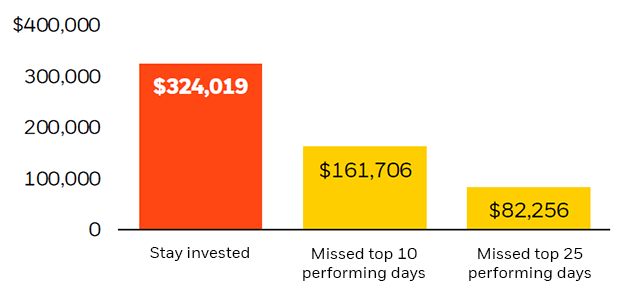

Historically, market rebounds are concentrated in a few distinct spurts. We expect the market to rebound again, but we can't know exactly when that will happen.

Performance is hypothetical for the period from 3/2/2000 to 2/28/2020 and for illustrative purposes only. Past performance does not guarantee future results.

Consider the above chart, which shows the hypothetical return of $100K invested in the S&P 500 Index from March 2000 to February 2020 (yellow bar). To the right, you can see the impact of having missed top-performing days. Staying invested earned more than double that of the portfolio which missed the top 10 performing days.

Investing tips to manage through market volatility

Here are some actions you may want to consider taking - and avoiding – when markets are volatile.

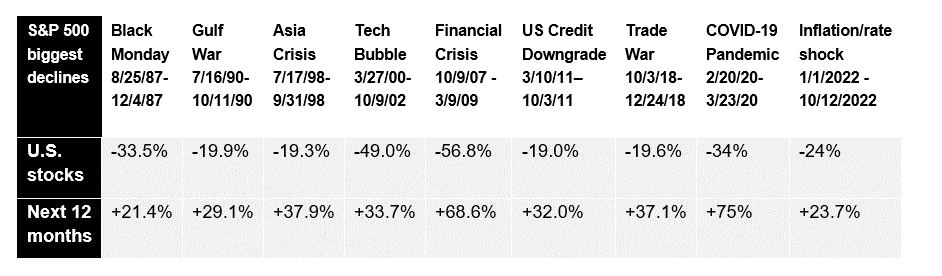

Long-term view versus short-term disruptions

Historically, stock market downturns are often followed by a period of positive market performance.

Source: Morningstar. Returns are principal only not including dividends. Stocks are represented by the S&P 500 Index, an unmanaged index that is generally considered representative of the U.S. stock market. Past performance is no guarantee of future results. For illustrative purposes only. It is not possible to invest directly in an index.

Every major decline from 1987 through 2022 in U.S. equities has reversed itself between 21% and 68% within the following year.

Other considerations before withdrawing retirement savings

We recognize that those who are experiencing significant and immediate financial distress may need to turn to their retirement plan for relief.

For those thinking about taking this course of action, here are some things to consider in advance:

- Take a look at your plan's rules

Make sure you are aware of your plan’s rules regarding loans and hardship withdrawals. If they are permitted, consider the applicable terms such as maximum amounts, eligibility criteria, and repayment terms and timing. - Explore other sources of emergency funds

Consider whether it would be less costly to take a personal or equity loan, or a loan from a family member, rather than draw on your retirement savings. - Consider potential financial implications

It's important to consider all the possible implications of taking a loan or withdrawal from your retirement plan. For instance, borrowing after a severe market decline may “lock in” losses, if you are not invested during a market rebound. In effect, you may be selling low and buying high. - Remember: Unrepaid loans may be treated like income

If you leave your job with an unpaid loan from your retirement plan, it may be treated – and taxed – as income, potentially adding another cost. In addition, early withdrawal penalties may apply to unpaid loan balances if you are under 59 ½. - Seek out advice

If you need help making a decision, you may want to consider speaking to a tax advisor, consulting with your plan sponsor or reviewing guidance from the Internal Revenue Service.